About HFAs

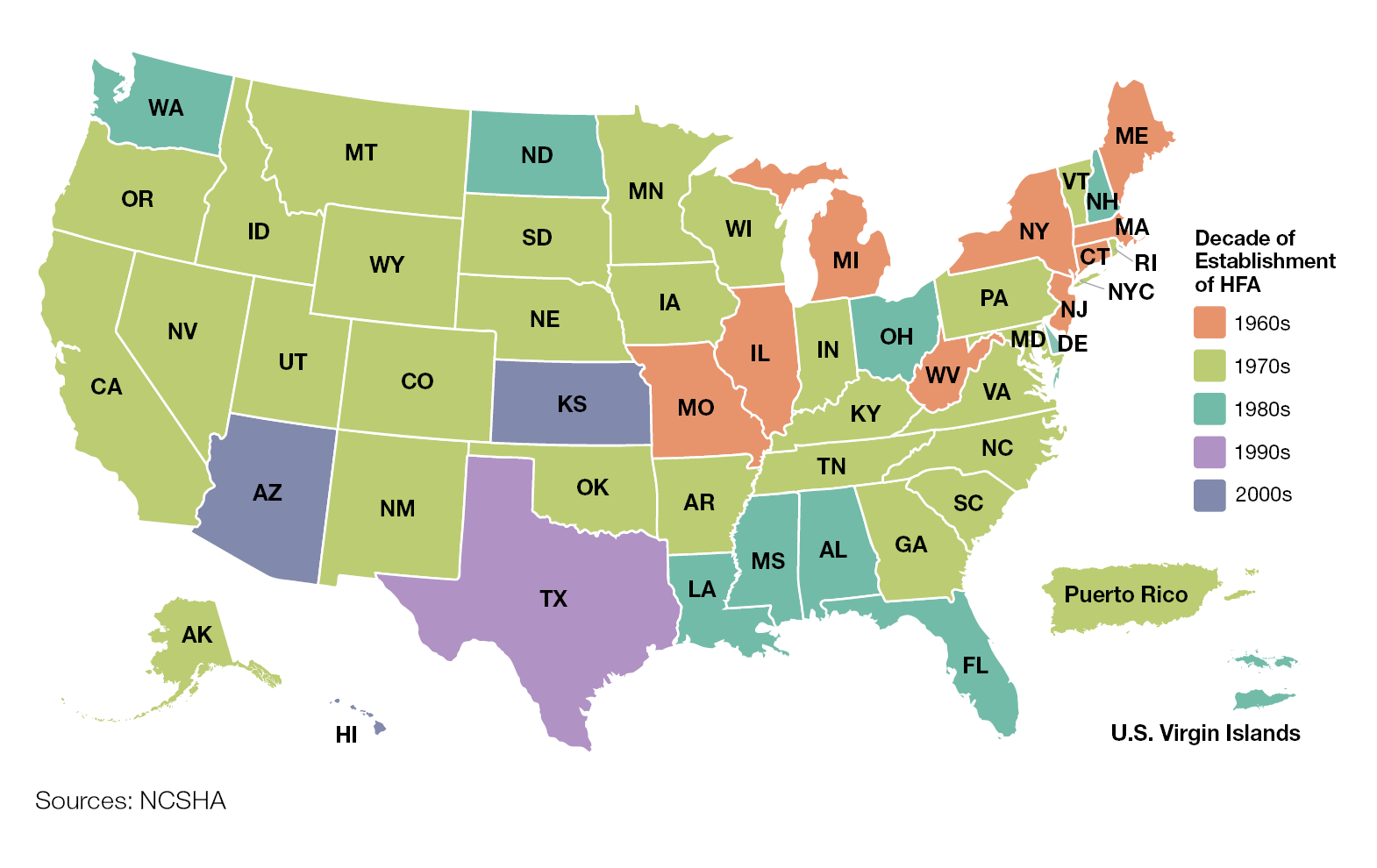

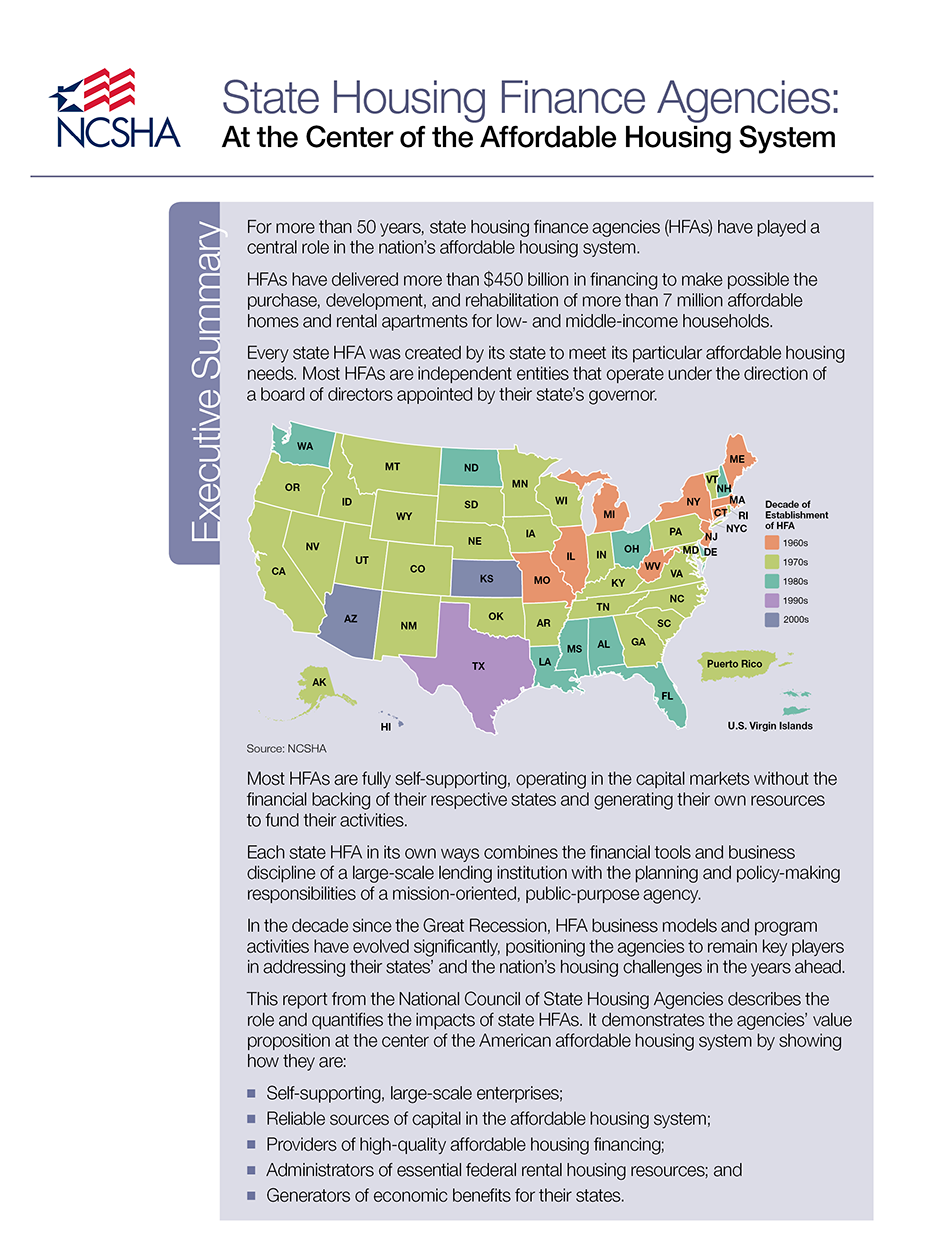

State Housing Finance Agencies (HFAs) are state-chartered authorities established to help meet the affordable housing needs of the residents of their states. Although they vary widely in characteristics such as their relationship to state government, most HFAs are independent entities that operate under the direction of a board of directors appointed by each state’s governor. They administer a wide range of affordable housing and community development programs.

At the center of HFA activity within the states and NCSHA’s work in Washington are three federally authorized programs:

- the Housing Bonds,

- the Housing Credit, and

- the HOME Investment Partnerships (HOME) program.

Using Housing Bonds, the Housing Credit, HOME, and other federal and state resources, HFAs have crafted hundreds of housing programs, including homeownership, rental, and all types of special needs housing. Many NCSHA member agencies also administer other federal housing programs, including Section 8 and homeless assistance.

HFAs have provided affordable mortgages to more than 3.4 million families to buy their first homes through the single-family Housing Bond program and other financing programs. HFAs have also financed approximately 4.6 million low- and moderate-income rental homes, including about 3.6 million rental homes using the Housing Credit.

HFAs have provided affordable mortgages to more than 3.4 million families to buy their first homes through the single-family Housing Bond program and other financing programs. HFAs have also financed approximately 4.6 million low- and moderate-income rental homes, including about 3.6 million rental homes using the Housing Credit.

Each year, NCSHA surveys its member state HFAs to collect data on them and their programs, publishing the results in its State HFA Factbook. The most recent Factbook also includes cumulative program statistics.

| Find a State Housing Finance Agency | Explore HFA Careers |

|

State HFAs: At the Center of the Affordable Housing SystemData and analysis quantify the importance and the impact of state HFAs. |

Photo Credits:

Colorado Housing and Finance Authority

Oklahoma Housing Finance Agency

Vermont Housing Finance Agency

Wisconsin Housing and Economic Development Authority