About Fiscal Recovery Funds NCSHA Survey Results Featured State In Action Additional Resources

NEWS: Treasury Department Boosts Affordable Housing with Fiscal Recovery Funds

NCSHA Survey: How States Are Using Fiscal Recovery Funds for Affordable Housing

NCSHA conducted a survey of its Housing Finance Agency (HFA) members on the use of Coronavirus State and Local Fiscal Recovery Funds (FRF) for affordable housing. The survey was designed to collect information about how states expect to use recovery funds for affordable housing, total dollars committed to affordable housing, the HFA role in administration, proposed affordable housing activities, and anticipated leveraging resources.

Based on 46 responses received as of April 18, 2023, key findings from this survey are summarized below.

States Devoting Fiscal Recovery Funds to Affordable Housing

Nearly 70 percent of the agencies responding (31 of 46 agencies) expect their states to devote fiscal recovery dollars to affordable housing activities, while 22 percent (10 of 46) do not. This decision has yet to be made in the remaining states.

|

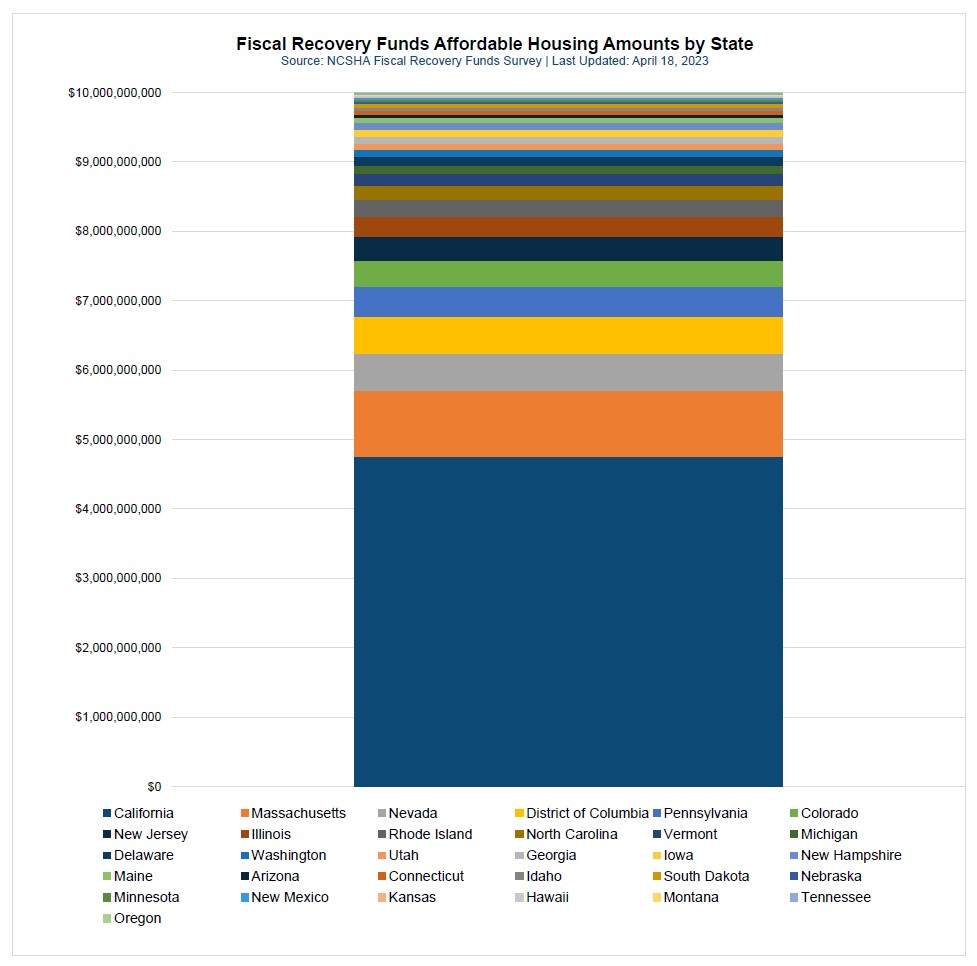

More Than $10 Billion in Affordable Housing Investment and CountingOf the 46 HFAs responding, 31 (67 percent) specified the total dollar amount their states are devoting to affordable housing activities. These 31 states — spread throughout every region of the country — have committed more than $10 billion to affordable housing. That historic amount may continue to grow as additional states finalize their recovery fund housing investment plans. (Click to enlarge chart) |

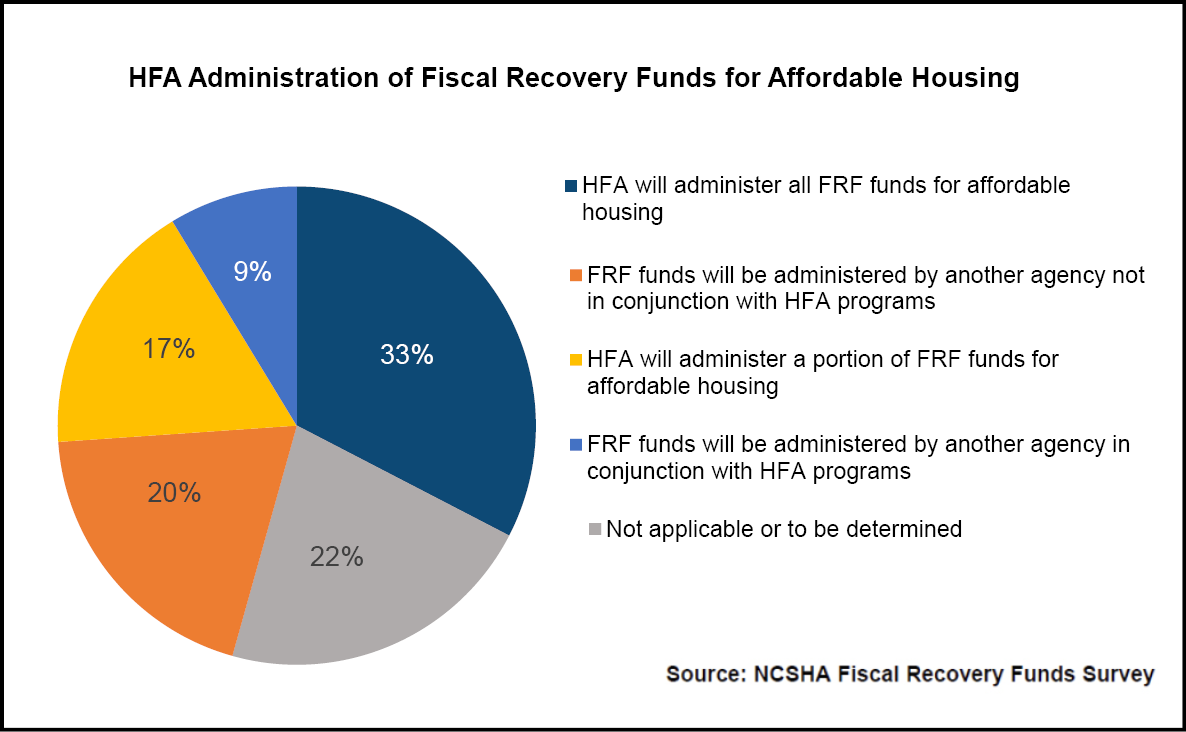

Administration of Fiscal Recovery FundsBased on the responses provided thus far, HFAs will administer all FRF dollars in approximately one-third (15 of 46) of the states. In another 17 percent of states (8 of 46), the HFA will administer a portion of the funds with the remainder administered by another state entity or entities. In four states (9 percent), the HFA will not administer FRF dollars directly, but at least a portion of the funds will be used in conjunction with HFA programs. In the remaining states, FRF dollars will be administered by other agencies and not in conjunction with HFA programs. |

(Click to enlarge chart) |

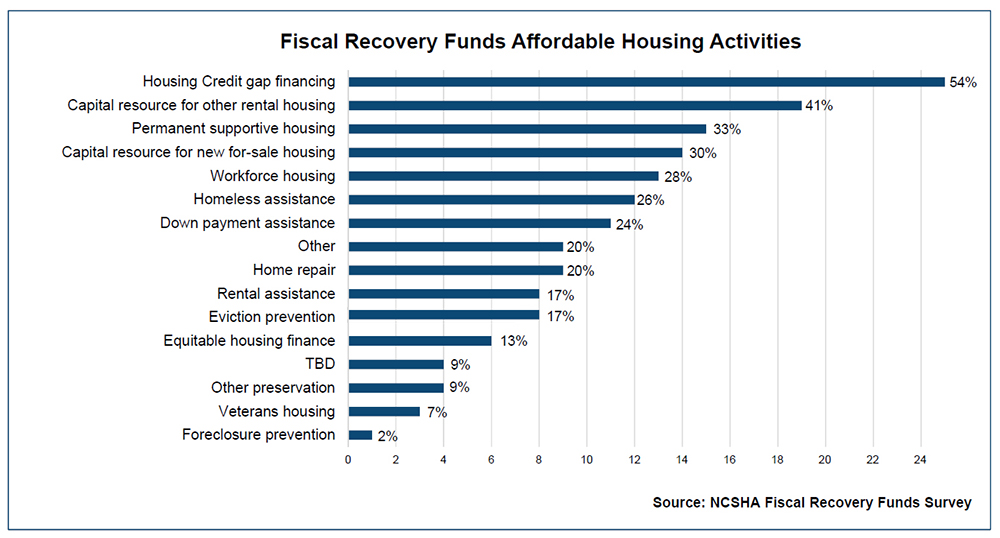

Anticipated Affordable Housing UsesConsistent with the program’s flexible nature, HFAs expect to use fiscal recovery dollars for a wide variety of affordable housing activities. The most frequently mentioned use among the 46 survey responses is as a capital resource to help finance Housing Credit properties (25 agencies / 54 percent), followed by a capital resource to finance other affordable rental housing production or preservation (19 agencies / 41 percent), permanent supportive housing (15 agencies / 33 percent), a capital resource to build new for-sale housing (14 agencies / 30 percent), and workforce housing development (13 agencies / 28 percent). Other common expected uses of FRF dollars for affordable housing include homeless assistance (12 agencies / 26 percent), down payment assistance (11 agencies / 24 percent), home repair (9 agencies / 20 percent), rental assistance (8 agencies / 17 percent), eviction prevention ( agencies / 17 percent), and equitable housing finance initiatives (6 agencies / 13 percent). |

|

(Click to enlarge chart) |

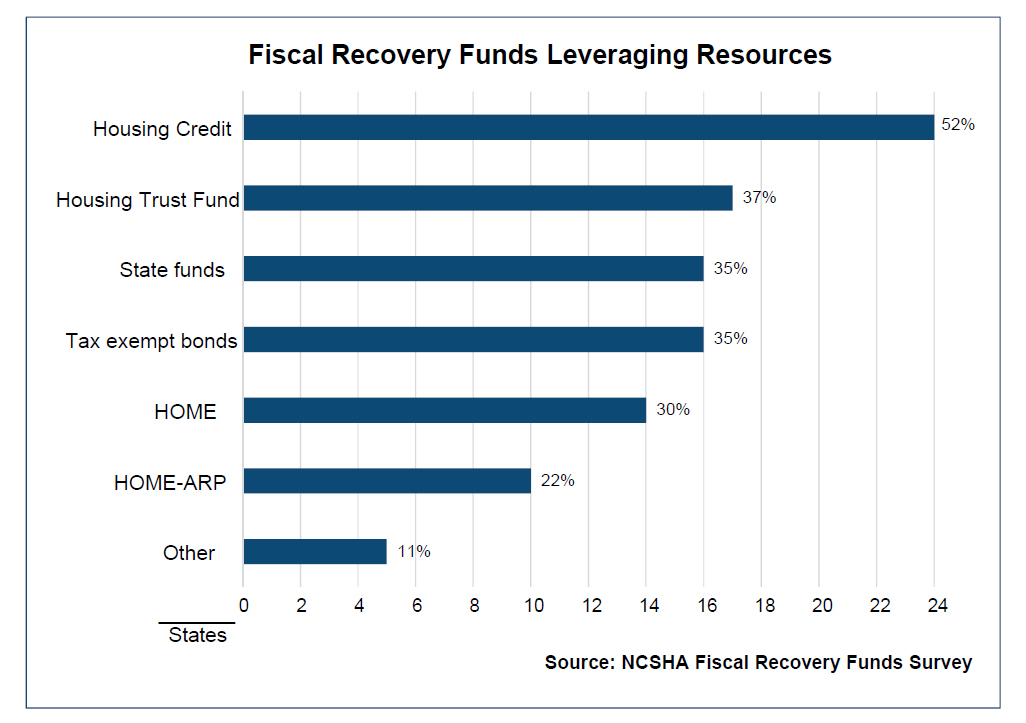

Leveraging ResourcesFinally, state HFAs plan to leverage FRF dollars with a variety of other affordable housing finance tools. The most common anticipated leveraging sources among the responding agencies include Housing Credits (24 agencies / 52 percent), Housing Trust Fund (17 agencies / 37 percent), state funds (16 agencies / 35 percent), tax-exempt bonds (16 agencies / 35 percent), HOME (14 agencies / 30 percent), and HOME-ARP (10 agencies / 22 percent). Survey Note: The results shared on this page are based solely on information provided to NCSHA by state-level program administrators. NCSHA will continue to update this page as it collects new data and changes to the information presented. |

|

(Click to enlarge chart) |

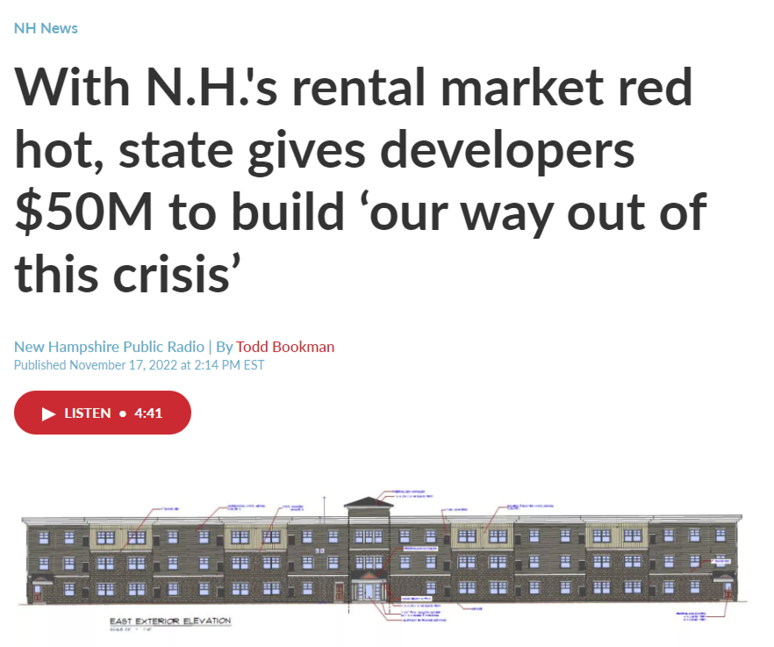

Featured State In Action: New Hampshire

|

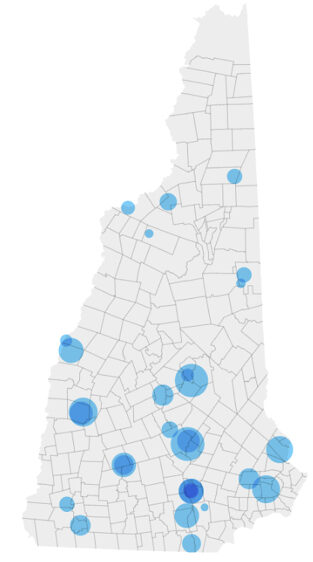

NCSHA Survey: New Hampshire Fiscal Recovery FundTotal Investment for Affordable Housing: $100 Million Administering Entity: InvestNH is funded through the Governor’s Office for Emergency Relief and Recovery using the state’s allocation of Fiscal Recovery Funds. A portion of the funds will be used in conjunction with New Hampshire Housing (HFA) programs. Uses for Affordable Housing: Capital resource (gap filler) to help finance Housing Credit properties; capital resource to finance other affordable rental housing production or preservation (not Housing Credit properties); workforce housing development; incentives for communities to approve permits for housing projects quickly; flexible grants for municipalities for housing and zoning activities FRF Leveraging Resources: Housing Credit, Tax exempt bonds Related News News and Resources

See Other States In Action |

About the Coronavirus State and Local Fiscal Recovery Fund

The Coronavirus State and Local Fiscal Recovery Fund (FRF), authorized in the American Rescue Plan Act in March 2021, provides $350 billion to state, local, and tribal governments to support their response to and recovery from the COVID-19 public health emergency. By statute, governmental entities receiving FRF may use these funds in four broad categories: to replace lost public-sector revenue; to respond to the far-reaching public health and negative economic impacts of the pandemic; to provide premium pay for essential workers; and to invest in water, sewer, and broadband infrastructure. The program provides flexibility for jurisdictions to meet local needs within these four eligible use categories.

The FRF final rule issued by the Treasury Department in January 2022 clarifies that recipients may use the funds for various affordable housing uses, all of which fall under the larger category of responding to public health and negative economic impacts of the pandemic. Eligible affordable housing activities include the development of affordable housing and permanent supportive housing, rental assistance, mortgage and down payment assistance, assistance with delinquent property taxes, and more.

However, despite its great potential for financing affordable housing, Treasury guidance initially set significant limits on the use of FRF to finance long-term loans due to certain statutory constraints. This created a barrier to its use as an affordable housing production resource. After much advocacy by NCSHA and its partners, in July 2022 Treasury modified its guidance to resolve the problem.

NCSHA’s Role in Making FRF a Viable Resource for Affordable Housing Production

The limitations Treasury initially placed on loans made with FRF were a major problem for affordable housing production because they resulted in a barrier to using FRF in conjunction with the Low Income Housing Tax Credit (Housing Credit) program.

Nearly all affordable rental housing built and preserved today relies heavily on Housing Credit equity. But Housing Credit equity alone typically is not enough to finance developments, which also require soft financing sources as gap filler to reduce the hard debt and allow rents to be affordable to low-income households. Soft financing sources are generally provided to Housing Credit projects as loans because of considerable drawbacks to the use of federal grants as a subsidy source.

NCSHA took a two-track approach to addressing the problem. First, it worked with housing champions in Congress to develop legislation that would amend the underlying statute so FRF grantees could make loans to Housing Credit properties under development. In March 2022, Representatives Alma Adams (D-NC) and David Rouzer (R-NC) introduced the legislation — the LIFELINE Act — and Senators Patrick Leahy (D-VT) and Susan Collins (R-ME) soon followed suit with Senate companion legislation. NCSHA organized a coalition of more than 100 organizations in support of the LIFELINE Act, all pressing Congress for its enactment.

Meanwhile, NCSHA continued to work with Treasury to improve its guidance through administrative action. Among other things, NCSHA provided Treasury with data on the amount of FRF funding that could be used for affordable housing production should Treasury modify its requirements.

As a result of this advocacy and the Biden–Harris Administration’s commitment to increasing the supply of affordable housing, in July 2022, Treasury released new guidance, in the form of an update to its Frequently Asked Questions, making an exception to the limitations on long-term loans for loans to affordable housing properties. Under the revised guidance, FRF may be used to finance the full principal amount of a loan with a maturity of 20 years or more made to affordable housing developments under certain circumstances. This change in guidance essentially mirrors what would have been achieved had Congress passed the LIFELINE Act.

Thanks to the change in Treasury’s guidance, FRF may now be used as a source of financing that state Housing Credit agencies may pair with Housing Credit equity to get these deals done.

U.S. Treasury Department Resources

|

NCSHA Resources

Additional Resources