COVID-19

CARES Act Program Instructions for Service Coordinators in Multifamily Housing, Congregate Housing Services Program

The U.S. Department of Housing and Urban Development issued this set of program instructions for the $10 million in CARES Act funding allocated for the Service Coordinators in Multifamily Housing program and Congregate Housing Services Program.

CDC Order to Temporarily Halt Residential Evictions to Prevent the Spread of COVID-19

On September 2, 2020, the Centers for Disease Control and Prevention issued this emergency public health order to temporarily halt evictions to prevent the further spread of COVID-19.

HUD Waivers, Alternative Requirements for the Emergency Solutions Grants Program Under the CARES Act

Issued on September 1, 2020, this notice from the U.S. Department of Housing and Urban Development announces the allocation formula, amounts, and requirements for the $3.96 billion in funding for the Emergency Solutions Grants Program under the CARES Act.

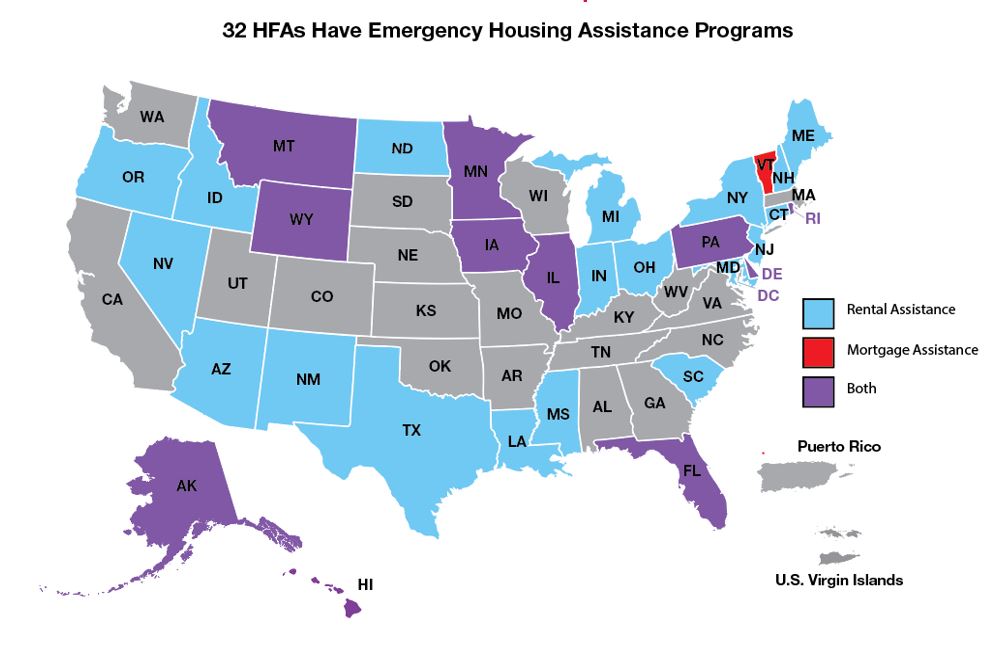

Matrix of State HFA Emergency Rental and Housing Assistance Programs

This matrix shows critical components of state HFA emergency rental assistance programs established in response to the COVID-19 pandemic.

HUD Guidance on CDBG Coronavirus Response Grants and FY 2019 and FY 2020 CDBG and Other Formula Programs Related to the CARES Act

This notice describes the program rules, statutory and regulatory waivers, and alternative requirements applicable to supplemental Community Development Block Grant (CDBG) funds made available under the Coronavirus Aid, Relief, and Economic Security (CARES) Act to prevent, prepare for, and respond to the coronavirus pandemic and to annual formula CDBG grants awarded in FY 2019 and FY 2020.

Bipartisan House Sign-On Letter Supporting Housing Credit Provisions in Coronavirus Relief Legislation

This letter, signed by 103 members of the House of Representatives from both parties, urges House leadership to prioritize an increase in the Housing Credit volume cap, establishment of a minimum 4 percent rate for bond-financed Housing Credit developments, basis boosts for certain properties, and lowering the “50 percent Test” threshold for triggering Housing Credit equity in bond-financed properties.

IRS Regulatory Relief Available During COVID-19 Pandemic (Updated)

This matrix compares the accommodations NCSHA requested in its March 23 letter to IRS to those allowed under existing IRS Revenue Procedures 2014-49 and 2014-50, which provide relief in instances of Presidentially-declared Major Disasters, and to recent IRS Notice 2020-23, which extends certain program deadlines until July 15, 2020.

House Member Sign-On Letter to Leadership Supporting Housing Credit Provisions in Coronavirus Relief Legislation

Representatives Suzan DelBene (D-WA) and Jackie Walorski (R-IN) are circulating this House of Representatives member sign-on letter in support of inclusion of the Low Income Housing Tax Credit priorities in the next coronavirus relief bill. The letter will be sent to House leadership.

IRS Notice 2020-53, Housing Credit Coronavirus Guidance

This notice extends and expands temporary relief provided under previous Notice 2020-23 from certain requirements under Section 42 of the IRC for Housing Credit properties in response to the ongoing COVID-19 pandemic. The deadline extensions and waivers provided in this Notice have since expired; however, the IRS issued subsequent Notices, Notice 2021-12 and 2022-05 providing further extension and expanding on the guidance in this Notice.