FHFA Reports GSEs Met 2018 Affordable Housing Goals and Duty-to-Serve Requirements

According to a report released today by the Federal Housing Finance Agency (FHFA), the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac in 2018 met all their affordable housing goals and their obligations under the Enterprise Duty-to-Serve Rule. The report, which FHFA submits to Congress each year, summarizes the GSEs’ 2018 affordable housing activities.

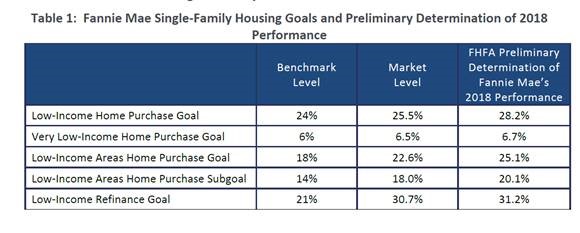

Affordable Housing Goals Achieved; Fannie Surpasses Single-Family Market Benchmark

The bulk of the report focuses on Fannie Mae and Freddie Mac’s 2018 performance under their 2018–2020 Affordable Housing Goals which establish minimum levels of support for affordable single-family and multifamily housing lending that both GSEs are expected to meet each year.

FHFA uses a dual approach to measure the GSEs’ compliance with their single-family goals and subgoals. Under this approach, FHFA requires each GSE to ensure a certain percentage (24 percent for 2018) of the loans it purchases each year be made to low-income consumers (those making 80 percent or less of area median income, or AMI). The GSEs are expected to meet this benchmark goal unless the share of home loans in the overall lending market made to low-income consumers falls below the benchmark. In that case, the GSEs’ level of support for low-income lending simply has to match that of the overall market for them to be considered compliant. FHFA takes an identical approach to measuring compliance with its single-family subgoals for loans to very low-income consumers (those at 50 percent of AMI or below), loans used to purchase homes in low-income areas, and refinance loans for low-income homeowners.

For the second year in a row, Fannie Mae achieved all its single-family goals and subgoals in 2018. Not only did Fannie Mae meet all its goals, it also exceeded the overall market for all subgoals despite the market levels all being higher than the benchmarks (see Table 1 from FHFA). Of Fannie Mae’s loan purchases, 28.2 percent were loans to low-income consumers, above the 24 percent benchmark goal and the 25.5 percent level for the market as whole.

Freddie Mac also reached all of its single-family housing goals in 2018, after a mixed performance in 2017. Its loan purchase shares did fall below the market as a whole for several subgoals (see Table 2 from FHFA).

As they have in the past three years, the GSEs exceeded their multifamily goals for 2018 (see Tables 3 and 4 from FHFA). In addition, both firms also increased their production in each goal category from 2017. The goals required them to finance the development of at least 315,000 units affordable to low-income renters earning 80 percent of AMI or below; at least 60,000 units affordable to very low-income renters earning 50 percent of AMI or below; and at least 10,000 units located in small multifamily properties that have between 5 and 50 units.

Duty to Serve Continues to Foster Housing Credit Investments

FHFA’s report also says the GSEs met their Duty-to-Serve obligations in the three underserved markets the rule targets: manufactured housing, affordable housing preservation, and rural housing. The report concludes that the GSEs’ efforts to promote residential economic diversity, which FHFA included as an additional target when crafting the Duty-to-Serve Rule, were largely ineffective. FHFA’s report cites Fannie Mae and Freddie Mac’s Housing Credit equity investments as supporting their efforts to finance affordable housing in rural areas. The GSEs are able to receive Duty-to-Serve credit for such investments.

Overall, Fannie Mae committed $118 million in Housing Credit equity to rural areas in 2018, supporting 42 properties, 13 of which were in high-needs rural regions such as Middle Appalachia or the Lower Mississippi Delta, which the Duty-to-Serve rule targets. The firm also made four Housing Credit investments to support housing for Native Americans living on tribal land, which FHFA has identified as a high-needs rural population in the Duty-to-Serve Rule. Freddie Mac, meanwhile, committed $73 million in Housing Credit investments to rural areas, supporting 17 properties, 5 of which are in high-needs rural regions.

The report also describes the allocations made by each GSE to the Housing Trust Fund and Capital Magnet Fund, breaks down Fannie Mae and Freddie Mac’s single-family loans by various underwriting and borrower characteristics, discusses the GSEs’ multifamily activities, and summarizes FHFA’s efforts to survey the mortgage markets and release some of the GSEs’ loan-level data to the public.