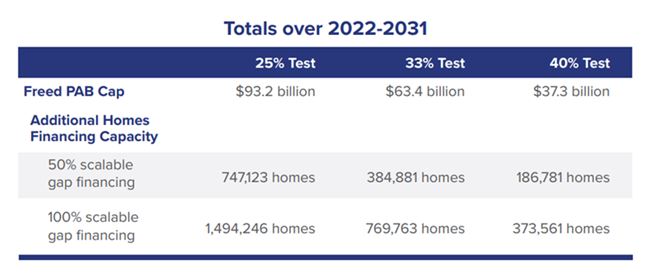

Lowering Bond Financing Threshold for 4 Percent Housing Credit Developments Could Result in Nearly 1.5 Million More Affordable Homes Over 10 Years

Today, NCSHA released a report that found lowering the bond financing threshold for Housing Credit properties — often referred to as the “50 percent test” — to 25 percent could result in the production of nearly 1.5 million more 4 percent Housing Credit units than would otherwise be produced between 2022 to 2031. Based on research conducted on NCSHA’s behalf by Novogradac, “Analyzing the Impact of Lowering the 50% Test for 4% Tax-Exempt Bond Financed Properties” is an update to previous analysis by Novogradac, also sponsored by NCSHA. The update was necessary to account for the minimum 4 percent Credit rate set in the Consolidated Appropriations Act of 2021 and significant changes in the Congressional Budget Office’s inflation projections since the first version of the report was published in May 2020.

The Tax Code currently requires that multifamily Housing Bonds be used to finance at least 50 percent of the aggregate land and building costs in order for a property to generate 4 percent Housing Credits on the entire amount of its qualified basis. Originally, the financed-by threshold was 70 percent, but Congress reduced that amount in 1990 as properties were unable to support such high debt service with Housing Credit reduced rents. However, even today, most properties — especially those in rural areas or properties serving very and extremely low-income tenants — are unable to generate enough rental income to support debt service if the property is financed with 50 percent debt. Thus, it is common practice for states to allocate enough bond authority to a development to generate the 4 percent Credits, with the expectation that, when the property is ready to place in service, the owner will refinance to a more manageable permanent debt amount. For states that have more demand than they have available bond authority, the financed-by threshold limits the amount of affordable housing they can produce with the bond volume cap available to them. In all states, it also results in higher transaction costs than would be required if the financed-by threshold were to be lowered.

The Novogradac analysis considers how much bond authority would be “freed” if the threshold were lowered to three different levels — 40 percent, 33 percent, and 25 percent — and estimates how many additional units that freed bond cap could be used to produce if states were to devote it entirely to multifamily Housing Bonds. The model assumes that, if the financed-by percentage was decreased, the tax-exempt debt would be replaced by taxable and/or recycled tax-exempt bond debt and that soft financing sources would be scalable for the additional production.

Given the impressive increase in production that can be achieved by lowering the financed-by threshold, the lead sponsors of the Affordable Housing Credit Improvement Act have included a new provision in the bill, introduced today, to lower the financed-by threshold to 25 percent.