GAO Report Says HUD Should Improve Metrics and Ongoing Oversight of RAD Program

A recent Government Accountability Office (GAO) report considering public housing conversions under the Rental Assistance Demonstration (RAD) program and its impact on residents raises concerns about how the Department of Housing and Urban Development (HUD) measures private-sector leveraging and its process for reviewing information to track the effects of RAD conversions on residents. The report is in response to a request by House Financial Services Committee Ranking Member Maxine Waters to review how RAD is achieving its goals, including long-term preservation of affordable units.

GAO finds fault in HUD’s system for measuring private-sector leverage in RAD properties. Specifically, HUD’s leveraging ratio counts some public resources as leveraged private-sector investment and does not use final, post-completion data, limiting HUD’s ability to assess private-sector leverage. GAO also found that there have been inconsistencies in HUD’s calculations from year to year.

GAO also raised concerns about HUD’s ability to collect final comprehensive financial data of the projects because HUD’s procedures do not require documentation on the final total cost figures, including construction costs, building and land acquisition costs, and developer fees. It also found that HUD does not systematically analyze household data on the effects of RAD conversions on residents. For example, HUD doesn’t keep track of household characteristics, such as rent change, before and after the project and relocation or displacement of households.

GAO also found HUD doesn’t have procedures in place to identify and respond to preservation risks to long-term affordability of units, including defaults or foreclosures. HUD officials said many of the RAD properties have other safeguards to secure the affordability of a unit, an example being that just under half of the RAD properties also use Housing Credit financing, which has oversight by allocators, lenders, and investors.

Based on its analysis, GAO makes the following five recommendations to HUD for improving leveraging metrics, monitoring the use and enforcement of resident safeguards, and compliance with RAD requirements:

- collect comprehensive high-quality data on financial outcomes upon completion of construction;

- improve the accuracy of RAD leverage metrics;

- prioritize monitoring development and implementation procedures to ensure resident safeguards are employed;

- determine how to use available data from existing Section 8 and public housing databases for analyses and enforcement of RAD resident protections;

- and prioritize the development and implementation of procedures to assess risks to the preservation of unit affordability.

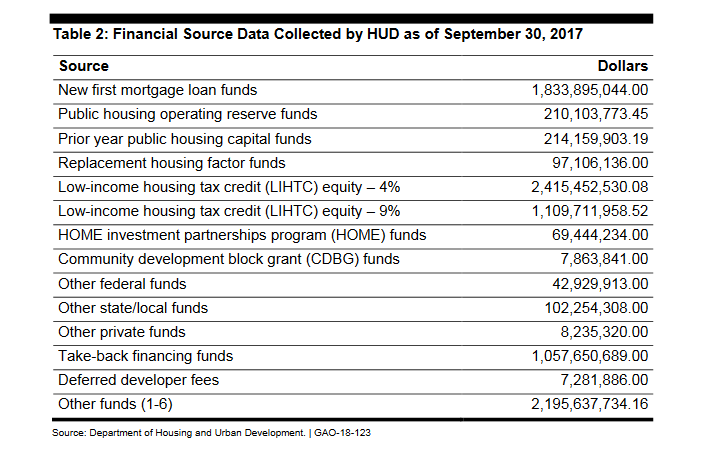

The report also provides general data on the RAD program. It finds that most RAD conversions involve rehabilitation or New Construction; 51 percent of active RAD conversions involved rehabilitation and 13 percent New Construction. Roughly 40 percent of all RAD conversions were financed through the Low Income Housing Tax Credit (Housing Credit) alone. As of September 30, 2017, out of 689 total conversions, 173 were financed with over $2.4 billion in 4 percent Housing Credit equity and an additional 99 were financed with over $1.1 billion in 9 percent Housing Credit equity. Additionally, RAD conversions have utilized over $69 million in HOME funds.

HUD agreed with GAO’s recommendations for improving its processes and metrics.