NCSHA COVID-19 Blogs, News, and Resources

The most recent NCSHA blogs, news, resources, statements, and talking points for HFAs are available below. For a curated compilation of COVID-19 information, guidelines, and notices published by state HFAs, the Administration, HUD, and other federal agencies, please visit the ![]() COVID-19 Resources and Updates Center.

COVID-19 Resources and Updates Center.

NCSHA Washington Report | April 19, 2024

A Senate hearing this past Wednesday entitled “Challenges in Preserving the U.S. Housing Stock” brought to mind longtime housing lawyer and legislative advocate Chuck Edson’s observation that...

NCSHA Washington Report | April 12, 2024

If you’re at all stressed about next week’s tax filing deadline, just wait til next year around now, when not only will everyone’s 2024 returns be due but our federal political system will be...

NCSHA Washington Report | April 5, 2024

The first flagship initiative of the Federal Housing Administration was not the home purchase mortgage insurance program the agency is known for today but rather a home improvement program...

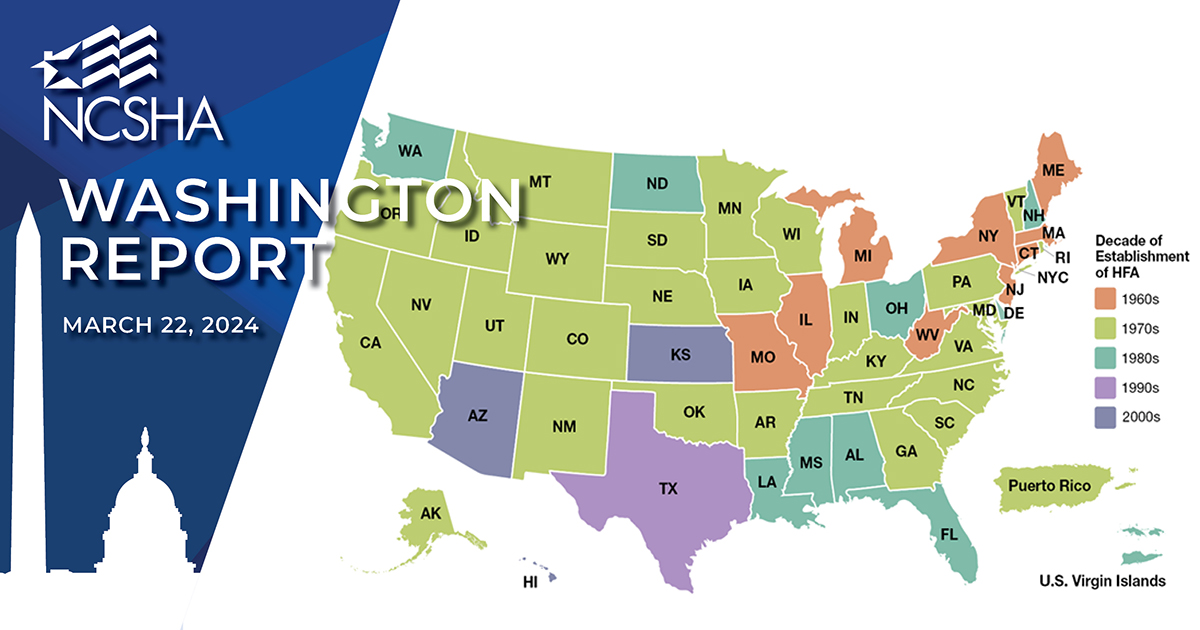

NCSHA Washington Report | March 22, 2024

Housing finance agencies have always acted as “gap fillers”: providers of the necessary capital to fund the difference between what it costs — under current conditions — to buy or build...

NCSHA Washington Report | March 15, 2024

No part of the country offers more compelling proof that solving housing affordability is a top priority for policymakers of every political persuasion than the Mountain West. From blue...

U.S. Treasury Department Emergency Rental Assistance Frequently Asked Questions (Updated as of March 5, 2024)

This FAQ document provides guidance regarding the Emergency Rental Assistance program enacted in the Consolidated Appropriations Act of 2021.

NCSHA Washington Report | March 1, 2024

This week the White House made its seventh major announcement since September 2021 of multiple steps the administration is taking through various federal departments to increase home building and...

NCSHA Washington Report | February 23, 2024

In early 1974, the burgeoning national network of the 27 state housing finance agencies in existence at the time was at a crossroads. Moody’s had recently changed its methodology for rating...

NCSHA Washington Report | February 16, 2024

As usual by around this time of year, most of the country’s governors have given their annual state of the state addresses, and many have submitted their budget proposals to their state...

NCSHA Washington Report | February 9, 2024

Nobody disagrees that the Low Income Housing Tax Credit is “the most important resource for creating affordable housing in the United States today.” The Housing Credit isn’t perfect —...

NCSHA Washington Report | February 2, 2024

Regrettably, if predictably, press coverage of the House’s passage of the Tax Relief for American Families and Workers Act by a 357–70 vote this week, containing a major expansion of the...

NCSHA Washington Report | January 26, 2024

Members of the U.S. House of Representatives: Your opportunity to vote, potentially next week, for or against the Tax Relief for American Families and Workers Act is — and is not — about a...